Contents:

- Why there are values only for period 01 to 05?

- Explanation of Units of Production Method of Depreciation

- How to get rid of Key in Tracing factors in SAP Distribution Cycle with Multiple Receivers

- The Difference Between Unit of Production and MACRS Methods

- Manage Spending – Cost Center Budget in SAP S/4HANA

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Next, we’ll learn how to journalize adjusting entries to record depreciation. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Suppose, as per the old method, the depreciation amount is $ 1000, but as per the new method, the depreciation amount is 2000. Salvage ValueSalvage value or scrap value is the estimated value of an asset after its useful life is over. For example, if a company’s machinery has a 5-year life and is only valued $5000 at the end of that time, the salvage value is $5000. The units of depreciation method is also known as the units of activity method. Use this calculator to calculate depreciation based on level of production for each period. Units of production is a differently worded version of our activity depreciation calculator.

This method provided depreciation based only on usage, but in reality, an end number of factors cause a reduction in the value of an asset. Accounting PolicyAccounting policies refer to the framework or procedure followed by the management for bookkeeping and preparation of the financial statements. It involves accounting methods and practices determined at the corporate level.

Using the previous example, assume you drove 20,000 miles the first year and 15,000 miles the second. The accumulated depreciation at the end of the second year is $5,250, or $3,000 plus $2,250. The depreciation expense per unit equals the depreciable cost divided by the number of units of output the business expects the asset to produce over its life. You might use miles driven for a vehicle, printed pages for a copy machine or machine-hours for a piece of equipment. Using the previous example, assume you expect to drive the vehicle for 100,000 miles over its life. The depreciation expense per mile equals $0.15, or $15,000 divided by 100,000.

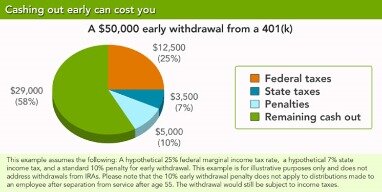

You’ll also want to make sure you’ve looked into Bonus Depreciation and Section 179 depreciation, which let qualifying businesses deduct the entire cost of many assets in the year of purchase. You cannot use units of production depreciation to calculate your tax deduction. However, it’s one of the four methods of depreciation allowed for Generally Accepted Accounting Principles . Units of production are especially appropriate for manufacturers whose usage of machinery varies by year because it matches the cost of the machinery to the revenue that it creates.

Operating Costs Definition: Formula, Types, and Real-World Examples – Investopedia

Operating Costs Definition: Formula, Types, and Real-World Examples.

Posted: Sun, 26 Mar 2017 05:08:57 GMT [source]

Working as a full-time freelance writer/editor for the past two years, Bradley James Bryant has over 1500 publications on eHow, LIVESTRONG.com and other sites. She has worked for JPMorganChase, SunTrust Investment Bank, Intel Corporation and Harvard University. Bryant has a Master of Business Administration with a concentration in finance from Florida A&M University. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. An asset will have a higher depreciation in years it is more productive and have a lower depreciation in years when less productive.

The four main depreciation methods mentioned above are explained in detail below. You can’t easily estimate how your assets will change until you close your books and look at the number of units you produced. The method first computes the average depreciation expense per unit by dividing the amount of depreciable basis by the number of units expected to be produced. You can’t use depreciation expense ceilings with the units of production depreciation method. The depreciation expense in an accounting period equals the number of units the asset produces during the period times the depreciation expense per unit. Accumulated depreciation equals the depreciation expense in the current period plus all depreciation taken in previous periods.

Why there are values only for period 01 to 05?

Unlike the other methods, the units of production depreciation method does not depreciate the asset based on time passed, but on the units the asset produced throughout the period. This method is most commonly used for assets in which actual usage, not the passage of time, leads to the depreciation of the asset. Aside from unit of production method, there are other methods of measuring the depreciation of assets. Another method commonly used for depreciation is the modified accelerated cost recovery system . This depreciation method is commonly used for tax purposes, it is a standard way to depreciate assets using a declining balance for a period of time. As required by the Internal Revenue Service, businesses depreciate assets using MACRS when filing their tax reports.

If the machine produces 10,000 units in the first year, the depreciation for the year will be $20,000 ($2 x 10,000 units). If the machine produces 50,000 units in the next year, the depreciation will be $100,000 ($2 x 50,000 units). The depreciation will be calculated similarly each year until the asset’s Accumulated Depreciation reaches $480,000. Step 1 → Estimate the useful life of the fixed asset in terms of the number of units produced, rather than in terms of years. Depreciation expense for a given year is calculated by dividing the original cost of the equipment less its salvage value, by the expected number of units the asset should produce given its useful life. Then, multiply that quotient by the number of units used during the current year.

Explanation of Units of Production Method of Depreciation

The public accounting-of-production depreciation method assigns an equal amount of depreciation to each unit of product manufactured or service rendered by an asset. Since this method of depreciation is based on physical output, firms apply it in situations where usage rather than obsolescence leads to the demise of the asset. Under this method, you would compute the depreciation charge per unit of output.

2022 Fiduciary Income 541 Tax Booklet FTB.ca.gov – Franchise Tax Board

2022 Fiduciary Income 541 Tax Booklet FTB.ca.gov.

Posted: Thu, 05 Jan 2023 22:28:40 GMT [source]

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

How to get rid of Key in Tracing factors in SAP Distribution Cycle with Multiple Receivers

For example, an asset produces 1000 units in 350 days and remains idle for 15 days. In this case, depreciation will be calculated based on 1000 units, i.e., only for 350 days. Depreciation for the idle period, i.e., 15 days, will not be calculated; hence it opposes the passage of time. The steps to calculate the unit of production depreciation expense for the crane in year one are calculate the units of production rate for the crane and calculate the crane depreciation expense. In the third step, multiply the number of units of actual production during a particular period to identify the total depreciation expense per unit for the accounting period in question. For example, a machine may be depreciated on the basis of output produced during a period in proportion to its total expected production capacity.

It equals the asset’s original cost minus its salvage value — the estimated value at the end of its life. For example, assume your small business buys a company car for $25,000 that you expect to resell for $10,000 at the end of five years. Its depreciable cost equals $15,000, or $25,000 minus the $10,000 salvage value.

Estimate the total number of hours of usage of the asset, or the total number of units to be produced by it over its useful life. A second justification for accelerated depreciation is that some types of property and equipment lose value more quickly in their first few years than they do in later years. Units of production method is useful in companies where usage varies asset to asset. Step 4 → The depreciation expense recorded in the accounting period is the product of the number of units produced and the rate of depreciation per unit. Step 3 → Divide the estimated production capacity from the cost basis of the fixed asset net of the salvage value assumption, which results in the depreciation per unit of production. Multiply the number of hours of usage or units of actual production by the depreciation cost per hour or unit, which results in the total depreciation expense for the accounting period.

The following example shows another example application of the units of production method of depreciation. The cost of some assets can be allocated easily according to their estimated production or output rather than their life. In effect, the depreciation expense recorded each year directly reflects how much of the fixed asset was used.

The Difference Between Unit of Production and MACRS Methods

Accumulated depreciation is the sum of depreciation expenses over the current and all prior years. The adjusted basis of your machine is the difference between the asset’s net cost and the total accumulated depreciation. Total accumulated depreciation isn’t allowed to exceed the machine’s net cost.

It is the most accurate method for charging depreciation, since this method is linked to the actual wear and tear on assets. However, it also requires that someone track asset usage, which means that its use is generally limited to more expensive assets. This method first requires the business to estimate the total units of production the asset will provide over its useful life. Then a depreciation amount per unit is calculated by dividing the cost of the asset minus its salvage value over the total expected units the asset will produce. Each period the depreciation per unit rate is multiplied by the actual units produced to calculate the depreciation expense.

Manage Spending – Cost Center Budget in SAP S/4HANA

If we assume that in 2021, a total of 20 million units were produced, we can arrive at the depreciation expense by multiplying our units of production rate by the actual number of units produced. It is charged based on usage of the asset and avoids charging unnecessary depreciation. Under this method, depreciation will be charged based on 5000 units for 340 days rather than full-year hence it provides a matching concept of revenue and cost. Do not use the units of production method if there is not a significant difference in asset usage from period to period.

2022 Corporation Tax Booklet Water’s-Edge Filers California Forms … – Franchise Tax Board

2022 Corporation Tax Booklet Water’s-Edge Filers California Forms ….

Posted: Thu, 05 Jan 2023 22:30:10 GMT [source]

You can change the method from a calculated, table, or flat-rate method to a production method only in the period you add the asset. This method is closely related to the units an asset produces during its useful life. Fixed costs are costs that remain the same even if production does not occur. Thus, the Units of Production method are appropriate for this type of asset. Again, the first step is the calculation of a rate by dividing the depreciable basis by the expected number of hours of operation.

What Does the Unit of Production Method Tell You?

This spreads the depreciation of those units evenly over the periods being depreciated. The calculation bases depreciation on the relative amount of units used since the last depreciation, compared to the life of the asset expressed in units. So, the company will record depreciation expense of $7,000 annually over the useful life of the equipment.

- The depreciation per unit is the depreciable cost divided by the number of units the equipment is expected to produce.

- At the end of the asset’s life when it has been fully depreciated, its book value equals its salvage value.

- In effect, the depreciation expense recorded each year directly reflects how much of the fixed asset was used.

- If you take a bite into an apple and let it sit, over time, the bite mark will begin to brown.

It is difficult to derive the correct value of depreciation under this method because it applies only to users and ignores the efflux of time. As we can see, the depreciation amount is increasing due to an increase in the production unit. Incidental ExpensesIncidental expenses are minor, non-budgeted expenses unrelated to primary service and do not arise during the normal course.

Rather, it takes into account that assets are generally more productive the newer they are and become less productive in their later years. Because of this, the declining balance depreciation method records higher depreciation expense in the beginning years and less depreciation in later years. This method is commonly used by companies with assets that lose their value or become obsolete more quickly.

So before selecting this method, please ensure everything is in control; otherwise, it will be challenging to use. As discussed in the next step, your annual depreciation cannot cause your accumulated depreciation to exceed your net cost of the asset. The unit of production method depreciation begins when an asset begins to produce units. It ends when the cost of the unit is fully recovered or the unit has produced all units within its estimated production capacity, whichever comes first.